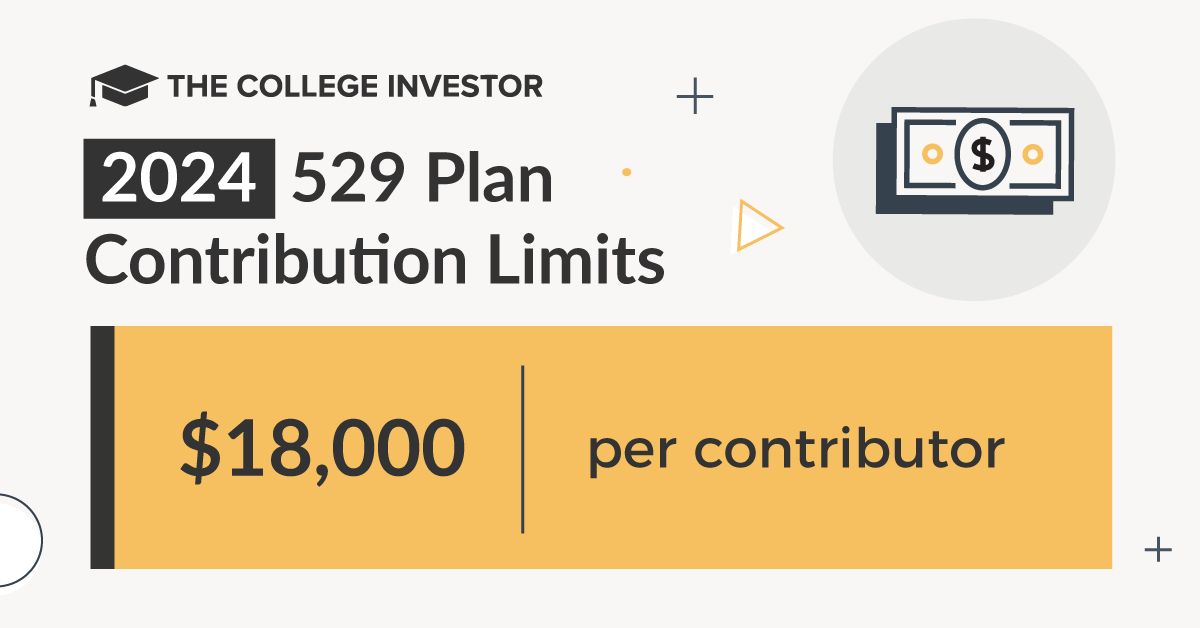

Contribution Limit For 529 In 2024. In 2024, the annual 529 plan contribution limit rises to $18,000 per contributor. In 2024, you can contribute up to $18,000 per beneficiary per year before you’d need to file irs form 709.

In 2024, you can contribute up to $18,000 per beneficiary per year before you’d need to file irs form 709. 529 rollover to roth ira 2024 deadline.

Nps Contribution Limit For Employer In Private Sector Raised From 10% To 14% Of The Employees Basic Salary.

Each state sets a maximum 529 plan contribution limit per beneficiary.

This Amount Varies By State;

The limit is $35,000, as long as the 529 account has been open for at least 15 years.

Contribution Limit For 529 In 2024 Images References :

Source: www.elementforex.com

Source: www.elementforex.com

529 Plan Contribution Limits For 2023 And 2024 Forex Systems, Explore what a 529 plan is and the best ways to save for future educational expenses. In 2024, the annual 529 plan contribution limit rises to $18,000 per contributor.

Source: blinniqjillana.pages.dev

Source: blinniqjillana.pages.dev

529 Plan Contribution Limits 2024 Joan Ronica, In 2024, you can contribute up to $18,000 per beneficiary per year before you’d need to file irs form 709. 529 rollover to roth ira 2024 deadline.

Source: tovaqclemmie.pages.dev

Source: tovaqclemmie.pages.dev

529 Plan Contribution Limits 2024 Aggy Lonnie, A recent change to tax law will permit people to transfer funds directly from 529 plans to roth iras. The 529 account must have been open for more than 15 years.

Source: karilqmarlena.pages.dev

Source: karilqmarlena.pages.dev

Max 529 Plan Contribution 2024 Inga Regina, A 529 college savings account is a powerful tool for families looking to save for future educational expenses. In 2024, the annual 529 plan contribution limit rises to $18,000 per contributor.

Source: www.sarkariexam.com

Source: www.sarkariexam.com

Max 529 Contribution Limits for 2024 What You Should Contribute, Good news, while there is a maximum aggregate 529 plan contribution limit, there is no annual 529 plan contribution limit! Contributions made to a 529 plan can be deducted from state taxable income up to a certain yearly limit.

Source: kimberlynwalvera.pages.dev

Source: kimberlynwalvera.pages.dev

Irs 529 Contribution Limits 2024 Rory Walliw, The 529 account must have existed for at least 15 years; Additionally, rollovers are subject to the maximum contribution limit for roth iras, up to $7,000 for investors 50 and younger for 2024.

Source: tybieqcoralyn.pages.dev

Source: tybieqcoralyn.pages.dev

Indiana 529 Contribution Limits 2024 Faythe Cosette, An important feature of 529 plans, which sets them apart from other investment accounts like roth iras, is that there is no annual. The 529 account must have existed for at least 15 years;

Source: www.youtube.com

Source: www.youtube.com

529 Plan Contribution Limits Rise In 2023 YouTube, If you qualify, this can be a great way to help kick start a beneficiary’s retirement savings. A 529 college savings account is a powerful tool for families looking to save for future educational expenses.

Source: julianawnoni.pages.dev

Source: julianawnoni.pages.dev

Iowa 529 Contribution Limits 2024 Nevsa Adrianne, The lifetime maximum a 529 beneficiary can transfer under the rule is $35,000; Individuals may contribute as much as $90,000 to a 529 plan in 2024 ($85,000 in 2023) if they treat the contribution as if it were.

:max_bytes(150000):strip_icc()/529-plan-contribution-limits-2016.asp_Final-28fe6ce80ec7400fb9e62e35624d8c2b.jpg) Source: www.investopedia.com

Source: www.investopedia.com

529 Plan Contribution Limits in 2024, In illinois, it is $10,000 for. In 2024, you can give up to $18,000 per person without impacting your lifetime gift tax exemption.

Each State Sets A Maximum 529 Plan Contribution Limit Per Beneficiary.

Since each donor can contribute up to $18,000 per.

Unlike Retirement Accounts, The Irs Does Not Impose Annual Contribution Limits On 529 Plans.

Annual contributions over $18,000 must be reported to the irs.

Posted in 2024