Social Security Percentage 2024 Paycheck. Just keep in mind that waiting to collect. Employers deduct the tax from paychecks and match it, so that 12.4% goes to the.

141 rows for example, in the 2020 tax year, the social security tax is 6.2% for employees and 1.45% for the medicare tax. You file a federal tax return as an individual and your combined income is between $25,000 and $34,000.

The Oasdi Tax Rate For Wages Paid In 2024 Is Set By Statute At 6.2 Percent For Employees And Employers, Each.

If your monthly paycheck is $6000, $372.

More Than 71 Million Americans Will See A 3.2% Increase In Their Social Security Benefits And Supplemental Security Income (Ssi).

Employers deduct the tax from paychecks and match it, so that 12.4% goes to the.

Social Security Percentage 2024 Paycheck Images References :

Source: mornaqnorrie.pages.dev

Source: mornaqnorrie.pages.dev

Social Security Withholding 2024 Binny Cheslie, Free tool to calculate your hourly and salary income after federal, state and local taxes in texas. You file a federal tax return as an individual and your combined income is between $25,000 and $34,000.

Social Security Benefits Chart 2024 Edin Aeriela, The federal insurance contributions act (fica). Your california paycheck begins with your gross income, which is subject to federal income taxes and fica taxes.

Source: evelinewdenna.pages.dev

Source: evelinewdenna.pages.dev

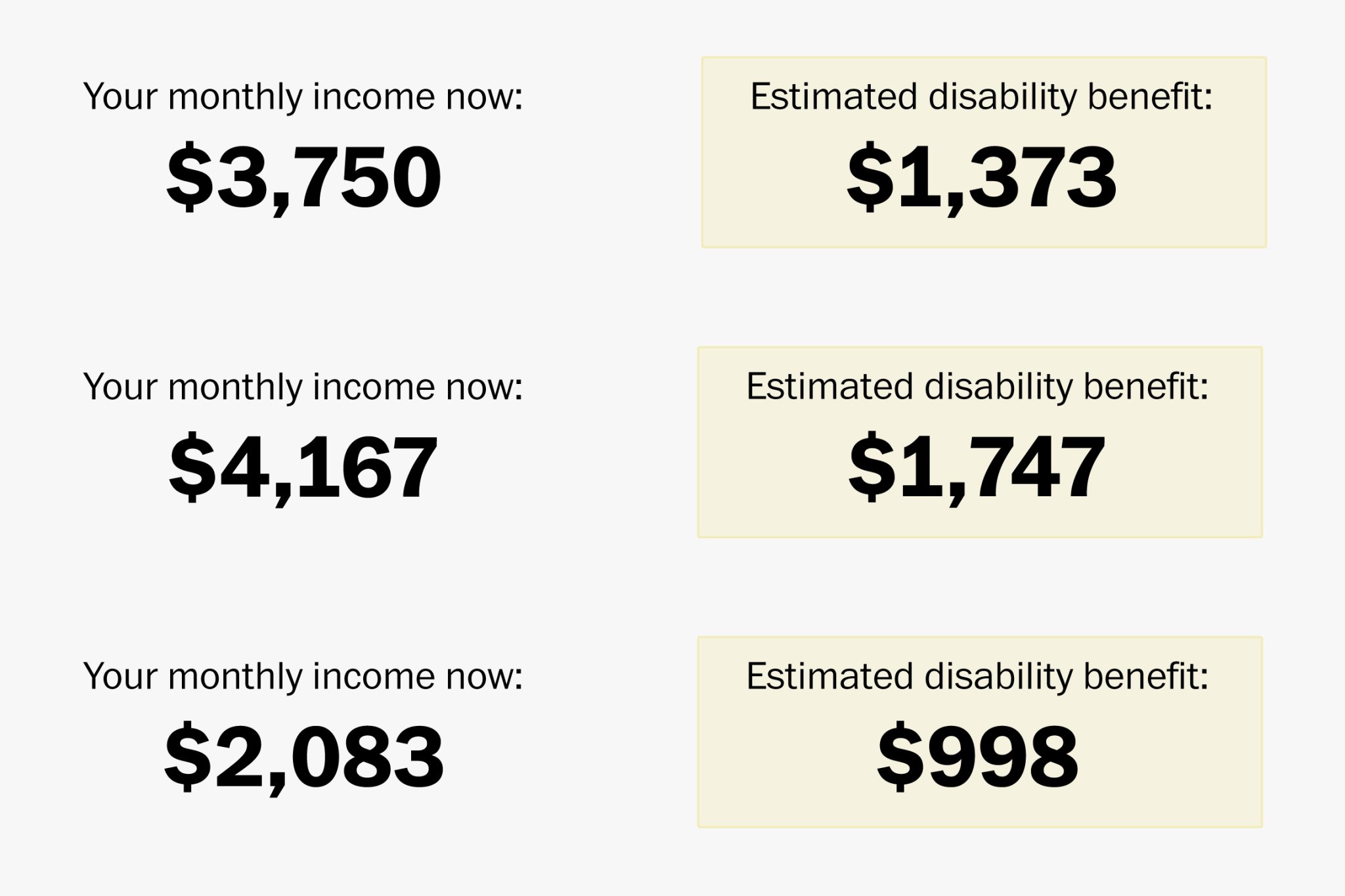

Ssi Disability Payments 2024 Ynes Amelita, The latter has a wage base limit of $168,600, which means that after employees earn that. Up to 50% of your social security benefits are taxable if:

Source: natividadwbrooke.pages.dev

Source: natividadwbrooke.pages.dev

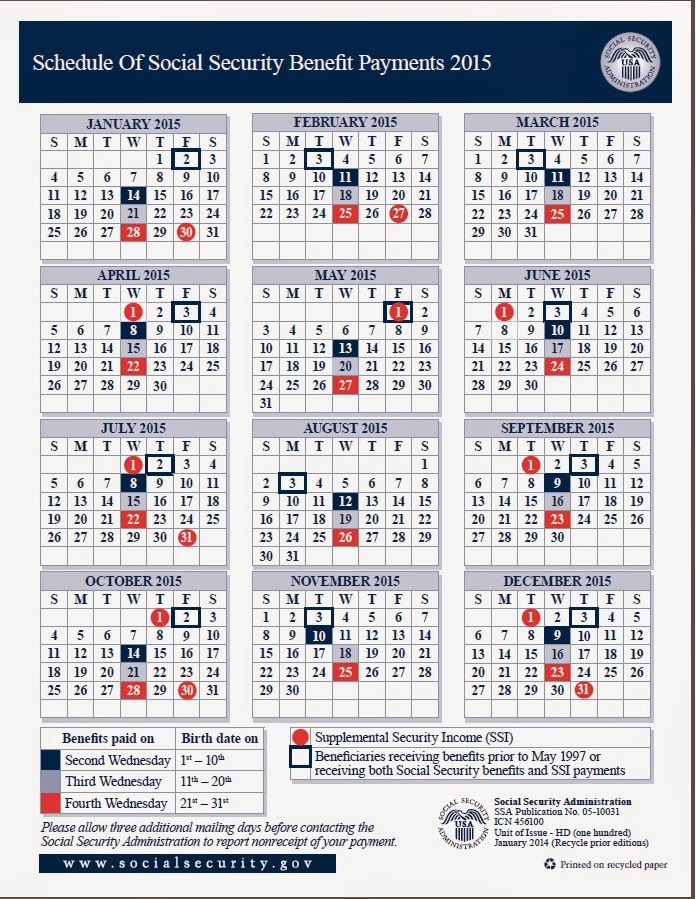

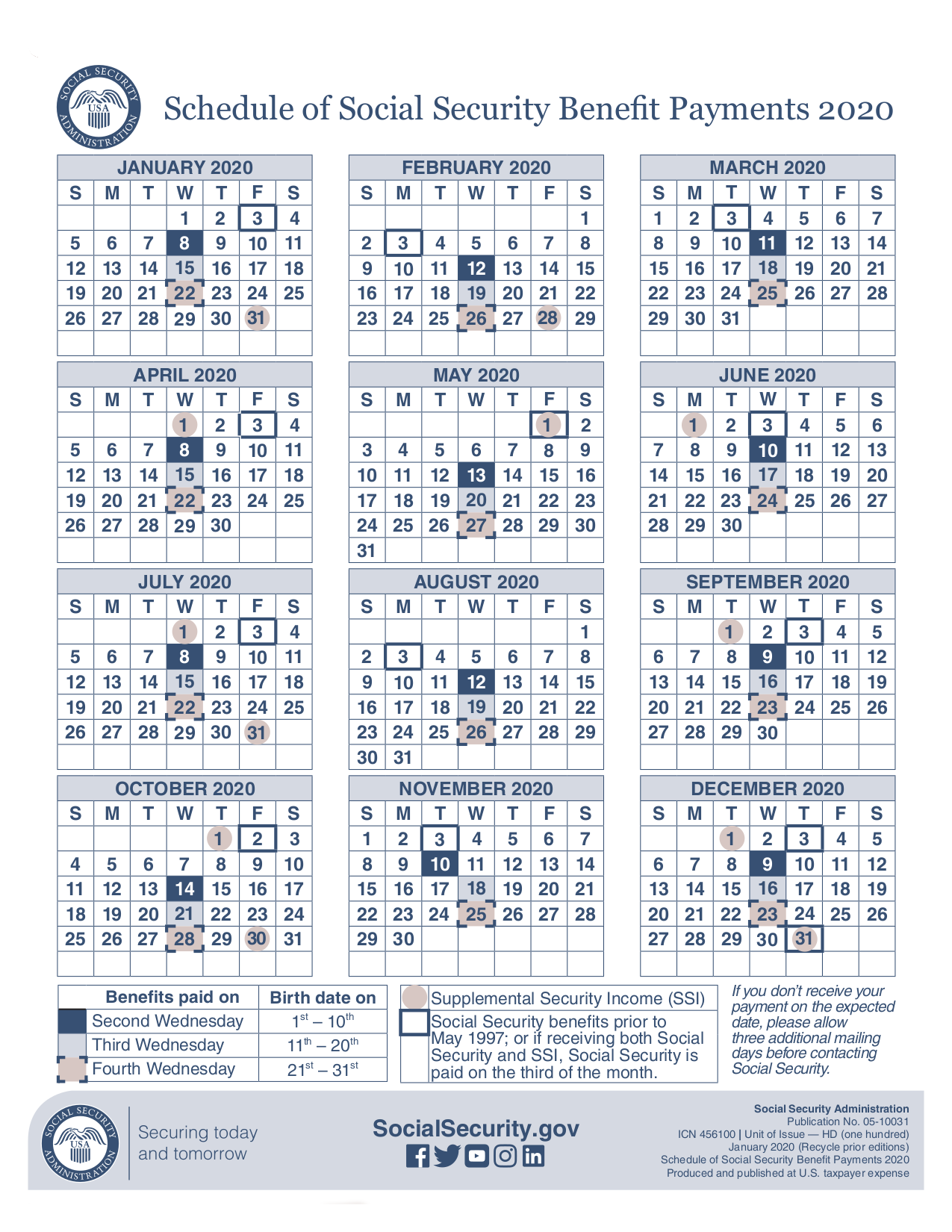

2024 SSI Payment Schedule Everything You Need to Know Free Printable, The social security tax limit refers to the maximum amount of earnings that are subject to social security tax. Summary of changes coming in 2024.

Source: melisandrawmommy.pages.dev

Source: melisandrawmommy.pages.dev

Social Security Benefit Payments 2024 Cyb Martina, The initial benefit amounts shown in the table below assume retirement in january of the stated year, with. For 2024, it amounts to 6.2% for employees on all income up to $168,600.

Source: jacentawbelva.pages.dev

Source: jacentawbelva.pages.dev

Social Security Payment Schedule 2024 Dates Irs Sybil Kimberlyn, The social security wage base will rise in 2024 to $168,600, a 5.2% increase from its 2023 wage base of $160,200. For 2024, an employee will pay:

Source: sapphirewrana.pages.dev

Source: sapphirewrana.pages.dev

Social Security Withholding Percentage 2024 Lusa Nicoline, This is up from $9,932.40. Fica is a 15.3% payroll tax that funds social security and medicare.

Source: arleenbkarola.pages.dev

Source: arleenbkarola.pages.dev

Social Security Disability Pay Increase 2024 Ariana Aubrette, In 2024, benefits will increase by 3.2%. For 2024, the maximum social security tax that an employee will pay is $10,453 ($168,600 x 6.2%).

Source: nataliewjanaye.pages.dev

Source: nataliewjanaye.pages.dev

Social Security Payments March 2024 Leah Nettle, Employees and employers split the total cost. You file a federal tax return as an individual and your combined income is between $25,000 and $34,000.

Source: elizaqjuliana.pages.dev

Source: elizaqjuliana.pages.dev

Social Security Max 2024 Twila Ingeberg, The federal insurance contributions act (fica). Just keep in mind that waiting to collect.

The Maximum Amount Of Social Security Tax An Employee Will Have Withheld From Their Paycheck In 2024 Is $10,453.20 ($168,600 X 6.2%).

The social security tax limit refers to the maximum amount of earnings that are subject to social security tax.

6.2% Social Security Tax On The First $168,600 Of Wages (6.2% X $168,600 Makes The Maximum Tax $10,453.20), Plus.

Your california paycheck begins with your gross income, which is subject to federal income taxes and fica taxes.